State taxes on the highest earners have not caused the wealthy to flee, and they have helped prevent some painful social service cuts.

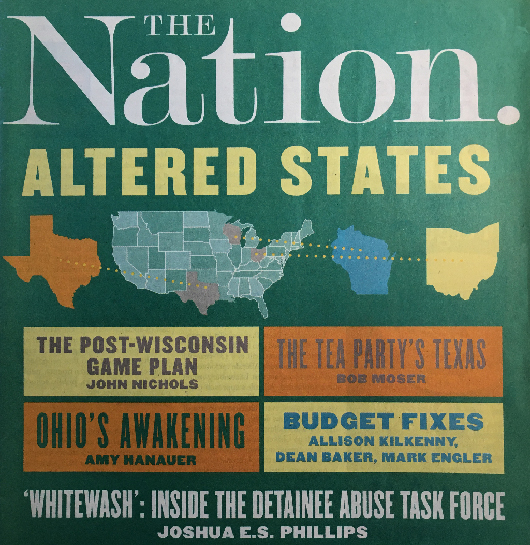

Published in The Nation.

In 2009, when then-New York Governor David Paterson signed a temporary tax increase on the state’s wealthiest individuals—one of the so-called “millionaire’s taxes” that have passed in recent years in select states across the country—at least one multimillionaire was not happy. Talk-show host Rush Limbaugh loudly proclaimed that he was selling his New York condominium and abandoning that state as a part-time residence.

“If I knew that would be the result,” Paterson joked in response, “I would have thought about the taxes earlier.”

While Limbaugh attempted to depict himself as part of a wider trend, new studies show that surtaxes on the wealthy do not cause an exodus of well-to-do taxpayers. Moreover, surveys demonstrate that Limbaugh’s unhappiness represents a decidedly minority position. With debate in Washington focused on reducing the federal deficit and states facing yawning holes in their budgets, few ideas garner more public backing than the notion that top earners should step up to help cover the gaps.

In New York, 71 percent of residents surveyed in a recent Siena poll favored an extension of higher taxes on the state’s wealthiest. “This has broad popular support across identifications—Republicans and Democrats, conservatives and liberals, upstate and downstate,” says Sunshine Ludder of New York’s Center for Working Families. “If you ask people whether they’d rather have a millionaire’s tax or have a billion dollars cut from education and healthcare budgets, the numbers go even higher.”

Responding to similar sentiments at the national level, a group led by Illinois Democrat Jan Schakowsky introduced the Fairness in Taxation Act on March 16, which would create a federal millionaire’s tax.

Currently, the tax system makes few distinctions among those in the top 3 percent. Households making $250,000 per year are subject to income tax rates almost identical to those who bring in hundreds of millions of dollars. As The New Yorker’s James Surowiecki quipped during last year’s debates over extending Bush-era tax cuts, LeBron James and LeBron James’s dentist now pay virtually the same rate.

The Fairness in Taxation Act would change this by creating a series of new tax brackets, starting at $1 million in income and going up to $1 billion. “There’s no reason to treat the wealthiest 1 percent of the country any more specially than anyone else,” stated Arizona Democrat Raúl Grijalva, a co-sponsor of the House bill, “and right now that’s exactly what our tax system is doing.” If enacted, the measure would raise more than $74 billion this year, according to estimates by the Citizens for Tax Justice.

With a Republican majority in Congress, the chances of passing a greater levy on the rich at the federal level are slim. But that has not stopped advocates from pushing to reform tax codes in the states, which tend to do even less to separate middle-class families from the most affluent residents. Since 2008, Connecticut, Hawaii, Maryland, New Jersey, New York, North Carolina, Oregon and Wisconsin have all enacted some version of a tax increase on top earners, with varying thresholds for when new rates kick in. The measure passed in New York in 2009 raised the state’s top tax rate by 1 percentage point for individuals with incomes over $200,000 (or over $300,000 for couples), and by just over 2 points for those with incomes over $500,000.

The impact of these changes has been significant. “They’ve improved what are overwhelmingly regressive and unfair state tax systems,” says Carl Davis, senior analyst at the Institute on Taxation and Economic Policy. “They have been able to help states avoid some really deep and painful cuts in important public services—layoffs of teachers and firefighters—and helped them continue to adequately fund healthcare and other safety net programs that people need the most in the recession.”

Despite these benefits, almost all of the taxes on the wealthy passed in 2008 and 2009 were temporary, designed to soften the blow of the economic downturn for one or two years. With these expiring, state legislatures are holding heated debates about whether surcharges should be extended.

Advocates for the taxes have drawn some unexpected allies. In March, a group of about 100 wealthy New Yorkers, including actor Mark Ruffalo, sent an open letter to state lawmakers arguing that the most fortunate, the letter’s signatories included, should continue to pay their fair share.

Yet the political climate for these drives has been inhospitable of late. In New York, Democratic Governor Andrew Cuomo joined Republicans in the State Senate to thwart a renovated millionaire’s tax this spring. An effort to retain an existing tax recently failed in Maryland. And in New Jersey, Republican Governor Chris Christie vetoed a similar measure in 2010, vowing to do so again this year.

During last November’s midterms, Washington State voters considered a ballot initiative that would have created two new brackets, one affecting households with incomes over $400,000 and the other for those making more than $1 million. It was defeated by a wide margin after business leaders such as Amazon.com founder Jeff Bezos and Microsoft CEO Steve Ballmer contributed to a $6.3 million campaign against it.

The opponents’ most common argument is that these taxes cause millionaires to flee across state borders. When Oregon reported that it collected substantially less from its tax on high earners during its first year than budget officials had projected, the Wall Street Journal pounced, casting the discrepancy as the result of an entirely predictable choice by wealthy taxpayers to depart. “The sun also rose in the east, and the Cubs didn’t win the World Series,” its editors wrote.

But information from Oregon’s Legislative Revenue Office indicated that the decline in the number of resident millionaires probably had little to do with migration. Rather, it suggested that people were simply making less money during the recession, thereby falling into lower brackets that were not subject to the new tax.

“The Journal just seized on the drop in the number of millionaires and immediately assumed that they all moved to Texas,” says Davis. “The data doesn’t indicate this at all.”

The academics who have conducted the most thorough research on the topic concur. Stanford professor Cristobal Young and Princeton sociology graduate student Charles Varner used tax data from New Jersey to determine the impact of a statewide hike on the wealthy passed in 2004. Their latest report, to be published in June, indicates that higher taxes created little flight while generating significant returns. “We calculate that there was essentially no out migration, and that the tax has raised about $1 billion per year,” Young says.

Like those in other income groups, the rich were far more likely to make decisions about where to live based on family, neighborhood and professional contacts—or on housing costs—than on tax increases.

Similarly, in April, Jeffrey Thompson of the Political Economy Research Institute at the University of Massachusetts published an analysis of IRS migration data in New England. Pointing out that “more than half of American adults have never lived in any state other than where they were born,” the report demonstrated that migration across state lines is relatively rare and that taxes have little role in people’s decisions to move. “These papers show that while state policy-makers may be afraid of taking the steps to generate revenue, some of their worst fears are unlikely to be realized,” says Thompson.

The billions of dollars already collected from taxes on top earners are hardly insignificant for cash-strapped states, and these measures could be even more vital in the long term.

“With so much income growth having been concentrated at the upper end of the scale, calibrating your tax system to take account of that fact is a good thing,” Davis says. “If millionaires continue to do as well in the years ahead as they have in years past, these can become very effective revenue-raising measures.